The 20-Second Trick For "Decoding the Relationship Between Obamacare Subsidies and Taxes"

Obamacare Assistances: What You Need to Understand Concerning Your Taxable Income

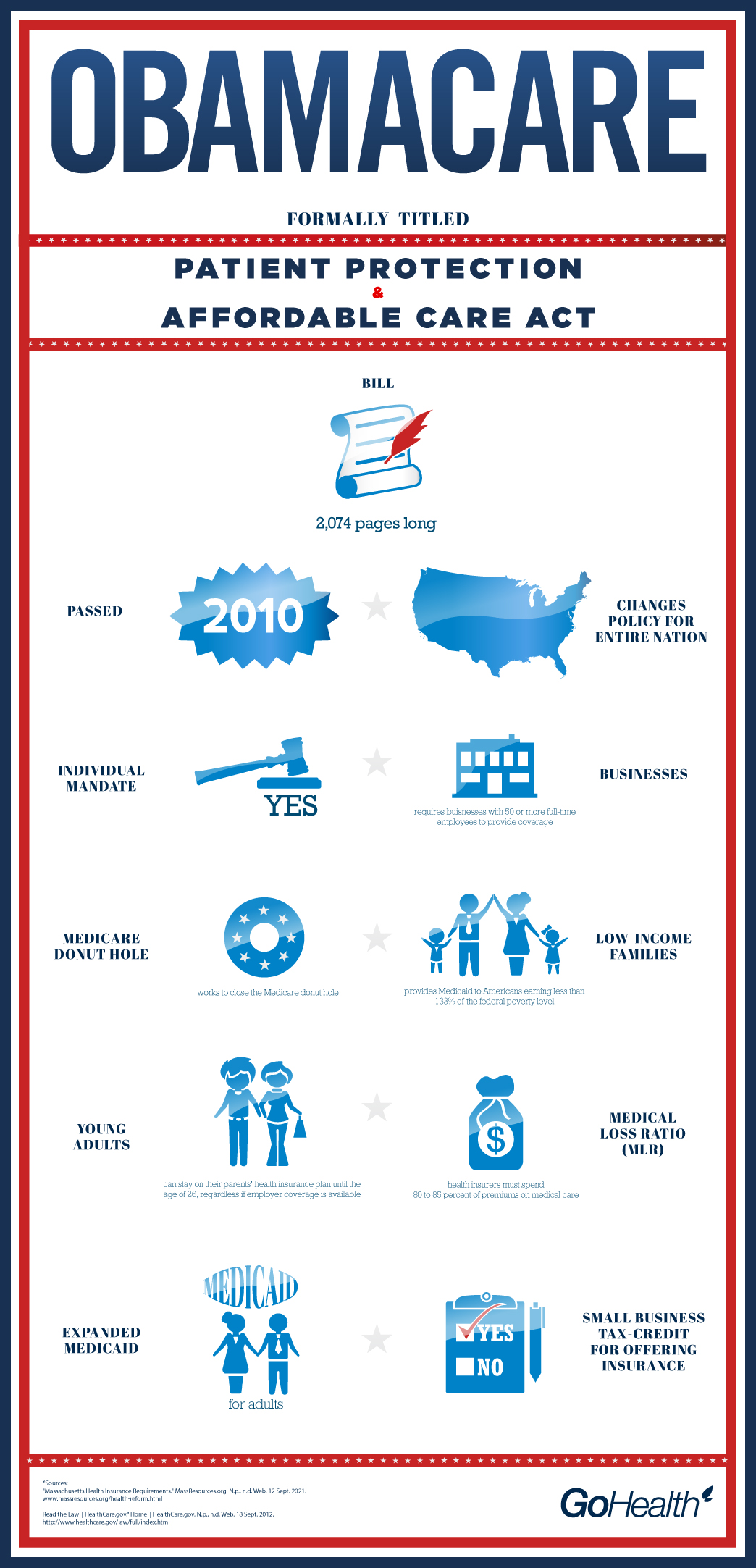

The Affordable Care Act (ACA) or Obamacare, as it is generally recognized, offers monetary assistance to low- and middle-income Americans in the type of assistances. These aids are designed to aid people manage health and wellness insurance coverage superiors and lessen their out-of-pocket medical expenses. However, many folks are not aware that these aids can affect their taxable earnings. In this message, we are going to review what you need to know regarding Obamacare assistances and your taxable income.

What Are Obamacare Aids?

Obamacare assistances are financial support supplied by the federal government government to aid people pay out for health insurance coverage premiums. The volume of subsidy you get relies on your profit and loved ones dimension. If you earn a lot less than 400% of the federal scarcity level (FPL), you might be qualified for a subsidy.

There are two types of Obamacare subsidies:

1. Premium Tax Credits - These income tax credit scores may be utilized to lower your month-to-month fee settlements for health and wellness insurance bought through the Health Insurance Marketplace.

2. Cost-Sharing Reductions - These reductions can lower your out-of-pocket medical expenditures like deductibles, copayments, and coinsurance.

How Do Obamacare Subsidies Have an effect on Your Taxable Revenue?

If you get a aid for health insurance policy fees with the Health Insurance Marketplace, it will definitely influence your taxable profit in two techniques:

1. Lower Your Taxed Income - The costs tax obligation credit rating decreases the quantity of loan you are obligated to repay on your government tax obligations through reducing your taxable revenue.

2. Enhance Your Taxable Income - If you take too lightly your income when administering for a assistance or if your true revenue is greater than what you stated on your app, after that you may possess to settle some or all of the assistance when filing taxes.

Let's look at an example: Suppose John earns $30,000 every year and obtains a $200 month-to-month premium income tax credit score for his health and wellness insurance coverage acquired via the Marketplace. This indicates his yearly subsidy is $2,400 ($200 x 12). To compute John's taxable income, we subtract the amount of the subsidy coming from his complete revenue. Thus, John's taxed earnings for the year would be $27,600 ($30,000 - $2,400).

On the other hand, if John ignored his earnings or possessed a raise during the year and didn't disclose it to the Marketplace, he might have to repay some or all of his subsidy when submitting taxes. In this case, if John's real earnings was $35,000 per year rather of $30,000 and he obtained a much larger assistance than he qualified for located on his genuine profit level. He would have to settle some or all of the excess subsidy quantity when submitting tax obligations.

How to Find out Your Eligibility for Obamacare Assistances?

To establish your eligibility for Obamacare assistances and how much you might receive in financial aid:

1. Solution Can Be Seen Here or your state's Health Insurance Marketplace website.

2. Enter your zip code and answer a couple of concerns concerning your household size and household earnings.

3. The website are going to present you available health insurance policy plans and approximate any type of superior tax credit histories or cost-sharing reductions you might qualify for based on your disclosed earnings.

4. You can easily choose a strategy that accommodates your necessities and budget plan based on this information.

It is essential to mention any modifications in your house measurements or revenue throughout the year as they may have an effect on your qualifications for assistances and how much you are obligated to repay when filing taxes.

Verdict

Obamacare assistances may provide substantial monetary support to those who certify but need to have mindful consideration as they may affect taxable profit both positively and detrimentally. It is necessary to comprehend how these subsidies work just before using for them so that you may make an informed selection concerning whether they are best for you. If you have any kind of questions regarding Obamacare subsidies or how they may affect your taxes, it is consistently absolute best to speak with a tax obligation specialist or healthcare navigator.